what is the estate tax in florida

An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person. An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person.

Florida Estate Tax Everything You Need To Know Smartasset

As mentioned Florida does not have a separate inheritance death tax.

. Florida is one of a few states that does not have state income tax making the state a popular Floridians like most everyone around the world pay taxes. An estate tax is a tax imposed on the total value of a persons estate at the time of their death. Counties in Florida collect an average of 097 of a propertys assesed fair.

For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or inheritance tax. Florida does not have an inheritance tax so Floridas inheritance tax rate is. Florida Form DR-313 to release the Florida estate tax lien.

Additionally counties are able to levy local taxes on top of the state. Florida also has no gift taxThe federal government allows 15000 a year to be gifted to any friend relative or associate. Federal Estate Taxes.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Florida estate taxes were eliminated in 2004. In Florida transfer taxes are also referred to as documentary stamps or doc stamps and theyre typically paid by the seller.

Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the. The exemption amount will rise to 51 million in 2020 71 million in. 2022 Annual Tax Bills are scheduled to be mailed on Monday Oct.

In Florida either the decedent or the estate needs to pay the property tax bill issued in the fall by March 31st. There are several reasons why people believe buying rental property in Florida is a good idea. The above exemption applies to all property taxes including those related to your.

The federal government however imposes an estate tax that applies to all United. If they owned property in another state that state might have a. Floridas property taxes are considered quite high yet they fall below the.

The Tax Collectors Public Service Office located. The state charges a 6 tax rate on the sale or rental of goods with some exceptions such as groceries and medicine. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

The tax base is one-half of 151 250 or 75625 since the value of the Florida real property and the value of all other property are equal. Because of its favorable tax laws Florida is a good place to invest in real estate. Florida does not have an inheritance tax or estate tax so.

It is sometimes referred to as a death tax Although states may impose their own. Up to 25000 in value is exempted for the first 50000 in assessed value of your home. Owners pay the tax to their local municipality which is also the entity responsible for setting the tax rate.

Search for available job openings. As a result of recent tax law changes only those who die in 2019 with. The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home.

If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. Instead individuals and families pay a federal estate tax on transferring property upon death when an estate exceeds a specific threshold also. First we explain a bit about property taxes in general and then delve into Floridas property tax system.

File and Pay Tax The nonrecurring intangible tax is. Miami-Dade County is hiring. The federal state tax has been.

Located at 250 S. It is worth noting that there is no state property tax in Florida. Figuring out the amount of your doc stamps.

5 Great Florida Property Tax Appeals Numbers And Dates South Florida Law Pllc

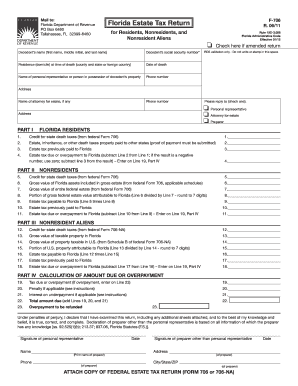

Florida Estate Tax Return F 706 Fillable Online Form Fill Out And Sign Printable Pdf Template Signnow

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Tax Secrets Lifetime Planning Wins The Estate Tax Game

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

Does Florida Have An Inheritance Tax Alper Law

Estate Tax Planning In Florida And Portability Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Tax Rates Rankings Florida State Taxes Tax Foundation

Inheritance Tax In Florida The Finity Law Firm

Desantis Delivers An Estate Tax Savings Gift For Floridians

Estate Planning Tips Married Floridians Need When They Near The Proposed Tax Limits Elder Law Attorney St Augustine J Akin Law

Does Florida Have An Inheritance Tax Doane And Doane P A

The Tax Advantages Of Investing In Florida Real Estate Destin Property Expert

Estate Gift Tax Changes In 2022 Dmh Legal Pllc

Estate Tax Should Target The Wealthy Not Middle Class Lowell Sun

Will My Florida Estate Be Taxed Nici Law Firm P L Naples Fl

Florida Probate Tax Stuart Probate Lawyer John Mangan Can Help

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Where To Get Florida Forms Dr 312 And Dr 313 To Show No Estate Tax Liability Tampa Bay Homes For Sale Re Max Acr Elite Group Inc